I recently inherited a property. What’s the next thing to do?

There are a few factors you want to consider when selling an inherited house. How fast do I need to sell, my timeline, and when I want to get paid.

If there is a mortgage on the home you’ve inherited, the specifics of the mortgage might affect how fast you decide to sell or rent the property.

Repairs to sell:

Repairs to sell: It is always a good idea to look at the repairs needed of the inheriting home. You’ll want to know about any big-ticket repairs that need to be done before selling the home — think furnace, roof and windows. Also check to see if the heating is gas or oil. In New Jersey underground oil tanks are a big problem. Home inspections are costly and take time.

Repairs to rent:

This option isn’t for everyone. Renters care less about the long-term condition of a property and more about the creature comforts, like new carpet and fresh paint. An alternative: Buyers will want big repairs completed before purchase. If you’re interested in selling the home without doing major repairs, consider selling it to Savannah Properties.

Savannah Properties will make selling your inherited home simple. When a loved one Wills a piece of real estate to a family member it is their intention that the sale or ownership of the property in will be beneficial to their heirs in some way. Inheriting a property can be a tough situation, a very stressful decisions both legal and personal. The correct choice is not always clear, especially with the suddenness of the situation. Savannah Properties is here to help you sell your inherited property hassle free.

Selling Inherited Property Or Taking Ownership Of The Inheritance

There is a few different avenues you can take with an inherited property in New Jersey such as keep it as a rental, possibly move into the property, or sell the house for cash as is quickly. Ask yourself, Do I want to sell or do I want to keep this inherited house? Property taxes, inheritance tax, insurance and mortgage are all relevant but do not over look home equity lines of credit or reverse mortgages. This is not only costly before you have received any money for the house but also time consuming.

Listing Property

Listing the property on the New Jersey MLS can be costly and time consuming. Paying for repairs will be added with realtor commissions and broker fees as well along with additional holding costs. This whole process between probate, repairs to the property, listing the house, and actual days on market to take well over a year from start to finish. After realtor commissions and other fees it will add up to about 10% off of the purchase price.There is another option less frustrating, time consuming, and costly.

Sell fast for cash as-is

Savannah Properties can save you time and the hassle if selling your inherited property is the best thing for your family. This option is the fastest way to solve your problem. You can net a competitive sales price compared to listing the property minus commissions, repairs, and holding costs. Maybe you are in no rush to sell the inheritance property and do not mind waiting months or possibly years for a buyer. In that case selling to an Investor is not your solution.

Under water Mortgage

Your house could be “under water” and the mortgage on the property is more then what the home is worth. This along with other situations could warrant a short sale of your inherited property.

Inheriting a property in another state

You inherited a vacant property in another state and the costs are piling up. Savannah Properties pride ourselves on fixing problems with properties fast. Rather than waiting months or sometimes even years for a possible sale of your property. You can receive a cash offer today and avoid the stress of selling an inheritance. We also have a licensed realtor on staff who can help you sell for top dollar as well.

Inheriting a House in New Jersey

Inheriting a house in New Jersey can bring a mix of emotions and responsibilities. From legal implications to the potential emotional impact of dealing with inherited property, it is important to understand the process and the benefits of selling an inherited house quickly.

Legal Implications of Inheriting a Property

When you inherit a property, there are several legal aspects to consider. First, you need to determine the status of the property’s transfer, which could involve probate, a living trust, or a transfer on death deed. Each of these options has its own set of legal requirements and potential complications, so it is essential to consult with an attorney or a professional experienced in estate matters to help you navigate the process.

Potential Emotional Impact of Dealing with Inherited Property

Dealing with an inherited property can be an emotionally charged experience, especially if the house belonged to a close family member or friend. Memories and sentimental attachments to the property can make the decision to sell difficult. However, it is crucial to consider the practical aspects of inheriting a house, such as ongoing maintenance costs, taxes, and potential disputes among heirs.

Benefits of Selling an Inherited House Quickly

Selling an inherited house quickly has several advantages. First, a fast sale can help ease the emotional burden of dealing with the property and allow you to move on with your life. Second, selling quickly can help you avoid the costs associated with holding onto the property, such as property taxes, insurance, and maintenance expenses. Finally, selling an inherited house in a timely manner can reduce the likelihood of disputes among heirs, making the process smoother for everyone involved.

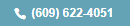

The Probate Process in New Jersey

When dealing with an inherited house in New Jersey, one of the most important aspects to understand is the probate process. Probate is a legal procedure that involves settling the estate of a deceased person and distributing their assets according to their will or state law. In this section, we will explore the definition and purpose of probate, its impact on selling an inherited property, and the types of properties exempted from this process.

A. Definition and Purpose of Probate

Probate serves two main purposes: to ensure that the deceased’s debts are paid and that their assets are distributed to the rightful heirs or beneficiaries. This process is overseen by a probate court, which appoints an executor or administrator to manage the estate. The executor is responsible for identifying and gathering the deceased’s assets, paying outstanding debts and taxes, and distributing the remaining assets according to the will or state law.

B. How the Probate Process Affects Selling an Inherited Property

Selling an inherited house in New Jersey may be affected by the probate process. If the property is part of the estate, it cannot be sold until the probate process is complete. This can take several months or even years, depending on the complexity of the estate and any legal disputes. During this time, the executor is responsible for maintaining the property, including paying property taxes, insurance, and other expenses.

Once the probate process is complete, the executor has the authority to sell the property. If there are multiple heirs or beneficiaries, they may need to agree on the sale or the court may order the sale as part of settling the estate. It’s essential to work closely with an experienced real estate professional who understands the probate process and can guide you through the necessary steps to sell the inherited house.

C. Properties Exempted from Undergoing the Probate Process

Not all inherited properties in New Jersey need to go through probate. Some properties may be exempted from the process if they are held in a living trust, have a transfer on death deed, or are owned jointly with rights of survivorship. In these cases, the property can be transferred directly to the beneficiary without the need for probate court approval. This can save time and make the process of selling the inherited house easier and faster.

In conclusion, understanding the probate process in New Jersey is crucial when dealing with an inherited property. By familiarizing yourself with the legal requirements and working with an experienced real estate professional, you can navigate this complex process and sell your inherited house in the best possible manner.

Factors to Consider Before Selling an Inherited House in NJ

When dealing with an inherited house in New Jersey, there are several essential factors to consider before making the decision to sell. These factors play a crucial role in ensuring a smooth and successful selling process, as well as helping to maximize the property’s value. In this section, we will discuss the value of the property, outstanding mortgage and debts, the number of people inheriting the property, and the status of home transfer.

Value of the Property

One of the most critical factors to consider is the current market value of the inherited house. A professional and trustworthy real estate agent or appraiser can help determine the property’s value based on factors such as location, condition, and comparable sales in the area. Understanding the market value will not only inform your decision-making process but also help you set a realistic selling price for potential buyers.

Outstanding Mortgage and Debts

Another important factor to consider is the outstanding mortgage and any other debts associated with the inherited property. These financial obligations must be addressed before the property can be sold. It’s essential to gather all relevant financial information and consult with an experienced real estate attorney or financial advisor to understand your options and responsibilities in addressing these debts.

Number of People Inheriting the Property

When multiple individuals inherit a property, it can add complexity to the selling process. Communication and cooperation among all parties involved are vital to ensure a smooth and successful sale. It’s essential to discuss and agree upon the best course of action for selling the inherited house and how the proceeds will be divided among the inheritors.

Status of Home Transfer

The legal status of the home transfer, such as whether the property is in probate, part of a living trust, or subject to a transfer on death deed, can significantly impact the selling process. Understanding the legal requirements and timelines associated with each type of transfer can help you plan and prepare for the sale of the inherited property. Consulting with an experienced estate attorney or real estate professional can provide valuable guidance and support in navigating the complexities of home transfer and selling an inherited property in New Jersey.

In conclusion, understanding and addressing the factors mentioned above will help you make informed decisions and ensure a smooth and successful selling process for your inherited house in New Jersey. Keep in mind that professional guidance from experienced real estate professionals, attorneys, and financial advisors can provide valuable insights and support throughout the process.

Tax Implications of Selling an Inherited House in NJ

When selling an inherited house in New Jersey, it is crucial to be aware of the tax implications involved. These taxes can significantly impact your finances and should be factored into your decision-making process. In this section, we will discuss the capital gains taxes and other tax implications associated with selling an inherited property, as well as the process of reporting the sale.

Firstly, it is essential to understand that selling an inherited house may result in capital gains taxes. Capital gains tax is applied to the difference between the sale price of the property and its adjusted basis, which is typically the fair market value of the property at the time of the decedent’s death. However, the Internal Revenue Service (IRS) allows for a step-up in basis, which means that the basis is adjusted to the fair market value at the time of inheritance. This can significantly reduce your capital gains tax liability.

For example, if you inherited a house valued at $300,000 at the time of inheritance and sold it for $350,000, your capital gains would be $50,000. The capital gains tax rate depends on your income and the length of time you owned the property. Long-term capital gains tax rates currently range from 0% to 20% for assets held for more than a year. Short-term capital gains tax rates apply to assets held for a year or less and are equal to your ordinary income tax rate.

It is worth noting that New Jersey does not have a separate capital gains tax, but the gain is included in your taxable income and subject to the state’s income tax rates. Additionally, New Jersey imposes an inheritance tax on certain beneficiaries, so it is essential to consult with a tax professional to determine if you are required to pay this tax.

B. Reporting the Sale of Inherited Property

When it comes to reporting the sale of an inherited property, you must file a Schedule D with your federal income tax return. This form is used to report capital gains and losses from the sale of property, including real estate. You will need to provide information about the property, including the date it was acquired, the adjusted basis, the sale price, and the gain or loss on the sale.

It is essential to keep detailed records of the inherited property, including any improvements made, as this information will be necessary when calculating the adjusted basis. Additionally, you may need to file a New Jersey state income tax return to report the sale and any associated gains or losses.

In conclusion, understanding the tax implications of selling an inherited house in New Jersey is crucial for making informed decisions throughout the process. By considering capital gains taxes and reporting requirements, you can better prepare for the financial impact of selling your inherited property and minimize potential tax liabilities.

When it comes to selling an inherited property, it is crucial to approach the negotiation process strategically. To achieve the best possible outcome, you must set realistic expectations, avoid overpricing or undervaluing the property, and familiarize yourself with effective negotiation tactics and strategies.

Setting Realistic Expectations

Begin by understanding the current real estate market and how it affects the value of your inherited property. Research comparable properties in the area to establish a reasonable price range for your house. Remember that the condition of the property, its location, and other factors will play a role in determining its market value. By setting realistic expectations, you’ll be better prepared to negotiate offers and make informed decisions.

Avoiding High Listing Prices and Undervaluing the Property

It is essential not to overprice or undervalue your inherited property, as this can lead to a drawn-out selling process or leaving money on the table. An overpriced property may deter potential buyers, while undervaluing the property could lead to a lower return on your investment. Work with a trusted real estate professional to help you establish an accurate and fair market value for your inherited property.

Researching Negotiation Tactics and Strategies

Effective negotiation is an essential skill when selling an inherited property. Familiarize yourself with various negotiation tactics and strategies, such as understanding the buyer’s motivation, being flexible with the closing date, and knowing when to make concessions. By researching and practicing these techniques, you’ll be better equipped to navigate the negotiation process and secure a favorable deal for your inherited property.

In conclusion, successfully negotiating offers and pricing an inherited property involves setting realistic expectations, avoiding overpricing or undervaluing the property, and honing your negotiation skills. By doing so, you will be better positioned to sell your inherited house in New Jersey quickly and efficiently, ensuring a smooth transaction and a positive outcome for all parties involved.

Dealing with Challenges in Selling an Inherited House

When it comes to selling an inherited house, several challenges may arise during the process. Being prepared to tackle these obstacles can help ease the selling process and ensure a smooth transaction. Here are some common challenges and ways to address them:

Estate being kept in probate

Probate can be a lengthy and complex process, which may delay the sale of an inherited house. To expedite the process, it is crucial to work closely with an experienced probate attorney who can guide you through the necessary steps. Additionally, maintaining open communication with all parties involved, including the executor and other heirs, can help avoid misunderstandings and keep the process moving forward.

Equal distribution of estate value and assets

Distributing the estate value and assets among multiple heirs can be challenging, especially when some may have differing opinions on how the property should be sold. It is essential to establish a clear understanding among all parties and consider hiring a mediator to help reach a consensus. Once an agreement is reached, proceed with the sale and ensure that the proceeds are distributed fairly among the inheritors.

Discarding belongings

Dealing with personal belongings left behind in an inherited property can be emotionally taxing and time-consuming. To help ease this process, consider enlisting the help of close family members or friends to sort through the items. You can also hold a yard sale, donate to charitable organizations, or hire a professional clean-out service to handle the disposal of unwanted items.

Inherited property being underwater or needing extensive repairs

If the inherited house has an outstanding mortgage that exceeds its current market value or requires significant repairs, selling the property may prove challenging. In such situations, consider working with a professional home-buying company like Savannah Properties NJ. They specialize in buying inherited houses quickly and for cash, allowing you to sell the property “as-is” without any additional investments or hassle. Their flexible closing dates can also help accommodate any unforeseen circumstances during the selling process.

By understanding and addressing these challenges, you can ensure a more seamless and successful sale of your inherited house in New Jersey.

Conclusion

In conclusion, choosing the best way to sell an inherited house in NJ is crucial for ensuring a smooth and efficient transaction. By taking the time to research the various selling options, homeowners can make informed decisions that lead to a more successful outcome.

Selling an inherited house quickly and efficiently offers numerous benefits. Homeowners can avoid the emotional stress and financial burden associated with maintaining a property that they might not need or want. Furthermore, a quick sale can help resolve any legal issues related to the inheritance and provide a fair distribution of assets among heirs.

Savannah Properties NJ has established itself as a trusted solution for selling inherited property in New Jersey. With their professional, trustworthy, and customer-focused approach, they provide homeowners with the support and guidance needed to navigate the complex process of selling an inherited house. By offering a fast offer turnaround time, cash payment, and the option to sell houses “as-is”, Savannah Properties NJ is an ideal choice for those looking to sell an inherited house in the most efficient and stress-free way possible.

Get Expert Help Today

As you navigate the complexities of selling an inherited house in NJ, Savannah Properties is here to offer personalized assistance and solutions. With our expertise in buying inherited houses quickly and for cash, you can enjoy a hassle-free selling experience. Our services allow you to sell your house “as-is” and choose a closing date that works best for you. Discover how Savannah Properties can help you by visiting our website at savannahpropertiesnj.com .